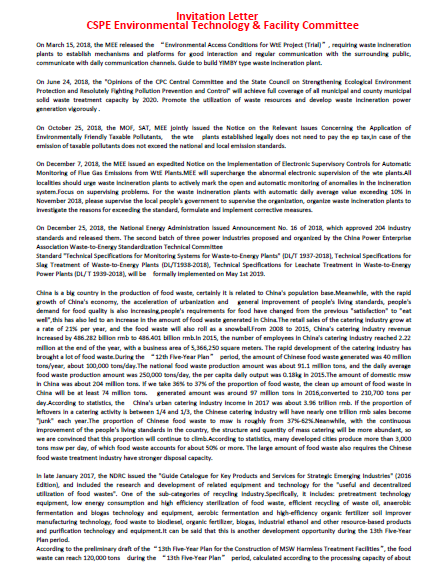

600+Global High Level Attendees

60+Renowned High Level Speakers

60+Selected Exhibitors Onsite

24+Local Municipalities

150+Biogas Biomass & WtE Investors and Operators

30+EPCs

15+RDF Producers,Cement Plants

150+Palm Oil,Sugar,Pulp and Paper Mill,Food & Beverage Factory,Tapioca Starch

Factories,Coconut Factory,Wastewater Treatment Plants,Rubber

Manufacturers,Industrial Parks,Textile Factory,Feed Mill,Coal fired power plants,Glassmaking Plants, Ceramics Factory etc

50+Wood Furniture Factory,Wood Processing Factory,Biomass Pellet Producers

Broaders solid waste series event was originated from the urban waste incineration power generation technology application seminar held in Shenzhen in 2004. It was held in Tianjin and Shanghai in 2005 and 2006 respectively. It was upgraded to the Asia Waste to Energy Congress in 2012 and moved to ASEAN in 2023 as the ASEAN Waste to Energy Week in Bangkok, Thailand,ASEAN Waste-to-Energy Week 2024 in Saigon Vietnam,Arab League Solid Waste Management Summit 2024 in Cairo Egypt,Asean Biomass Utilization Congress 2024 in BKK Thailand,Asean Solid Waste Management Congress 2024 in BKK Thailand. Asean Biomass Utilization Congress 2025 in KL Malaysia,Asean Solid Waste Management Congress 2025 in KL Malaysia. The conference attracted more than 5,500 delegates from more than 80 countries and regions including China, United States, France, Sweden, Austria, Finland, Norway, Iceland, Denmark, Poland, Czech Republic, Germany, Austria, Switzerland, Russia, Ukraine, United Kingdom, Ireland, Netherlands, Belgium, Italy, Spain, Portugal, Thailand, Japan, Singapore, South Korea, Malaysia, Australia, India, Indonesia, Philippines, Vietnam, United Arab Emirates,The Kingdom of Saudi Arabia,The Kingdom of Bahrain,Egypt,South Africa,The Kingdom of Morocco, Iran,The Islamic Republic of Pakistan,Bangladesh,Lebanon, Canada, Sri Lanka, South Africa, Hong Kong, Taiwan, Macau etc attended the conference. Previous participants have visited Beijing Lujiashan Shougang Biomass Waste Incineration Power Plant in 2014, Suzhou Everbright Waste Incineration Power Plant in 2015, Shanghai Environment Laogang Waste Incineration Power Plant in 2016, Shenzhen Energy Yantian Waste Incineration Power Plant in 2019, Guangzhou Third Resource Thermal Power Plant in 2021,Shenzhen Energy Longgang Energy Ecological Park in 2021,Bangkok BMA C&G Waste-to-Energy Power Plant in 2023,Everbright International's Can Tho Waste-to-energy Project in Vietnam in 2024.Thailand Chonburi Clean Energy Power Plant in 2024.Malaysia Sulpom Integrated Biomass-Based Cogeneration Power Plant in 2025,Berjaya EnviroParks,one of Malaysia's largest sanitary landfills,msw incineration plants,hazardous waste incineration plants in 2025.

Asia Waste to Energy Congress 2012 was held successfully in Pullman Shanghai Skyway Hotel from 15th-16th Nov 2012

2nd Annual Asia Waste to Energy Congress 2013 was held successfully in Pullman Shanghai Skyway Hotel from 24th-25th Sep 2013

3rd Annual Asia Waste to Energy Congress 2014 was held successfully in Renaissance Beijing Capital Hotel from 22nd-23rd Oct 2014

4th Annual Asia Waste to Energy Congress 2015 was held successfully in Pullman Shanghai Skyway Hotel from 24th-25th Sep 2015

5th Annual Asia Waste to Energy Congress 2016 was held successfully in Pullman Shanghai Skyway Hotel from 28th-29th Sep 2016

6th Annual Asia Waste to Energy Congress 2017 was held successfully in Pullman Shanghai Skyway Hotel from 30th Nov-1st Dec 2017

7th Annual Asia Waste to Energy Congress 2019 was held successfully in Saint Regis Shen Zhen Hotel from 28th Jun-29th Jun 2019

8th Annual Asia Waste to Energy Week 2021 was held successfully in Four Points Sheraton Guang Zhou Hotel from 27th-28th Sep 2021

Inaugural Asia Hazardous Waste Treatment Congress 2016 was held successfully in Pullman Shanghai Skyway Hotel on 27th Sep 2016

2nd Asia Hazardous Waste Treatment Congress 2017 was held successfully in Pullman Shanghai Skyway Hotel on 28th-29th Nov 2017

3rd Asia Hazardous Waste Treatment Congress 2018 was held successfully in InterContinental Nanjing Hotel on 26th-27th Sep 2018

4th Annual Asia Hazardous Waste Treatment Congress 2019 was held successfully in The Sofitel Nanjing Galaxy Hotel on 7th-8th Nov 2019

5th Annual Asia Hazardous Waste Treatment Congress 2020 was held successfully in Hilton Jinan South Hotel on 24th-25th Sep 2020

Asia Food Waste Treatment Congress 2019 was held successfully in Saint Regis Shen Zhen Hotel on 26th June 2019

ASEAN Food Waste Treatment Congress 2023 was held successfully in Hilton Sukhumvit Bangkok Hotel on 16th Oct 2023

Asean Waste to Energy Week 2023 was held successfully in Hilton Sukhumvit Bangkok Hotel on 18th-20th Oct 2023

Asean Waste to Energy Week 2024 was held successfully in Pullman Saigon Centre Hotel on 14th-16th Mar 2024

Arab League Solid Waste Management Summit 2024 was held successfully in Fairmont Nile City Cairo Hotel on 27th Jun 2024

Asean Biomass Utilization Congress 2024&Asean Solid Waste Management Congress 2024 was held successfully in Eastin Grand Hotel Sathorn Bangkok 27th-28th Nov,2024

Asean Biomass Utilization Congress 2025&Asean Solid Waste Management Congress 2025 was held successfully in Courtyard by Marriott Kuala Lumpur South Hotel 28th-29th Apr,2025

Asean Biogas&Biomethane Congress 2025��ID),Asean Biomass Utilization Congress 2025&Asean Solid Waste Management Congress 2025 was held successfully in DoubleTree by Hilton Jakarta Bintaro Jaya Hotel 23rd-25th Sep ,2025

The Broaders 29th Edition Solid Waste Series Event Will be Scheduled on 17th-19th Mar 2026 in Bangkok

Asean Biogas&Biomethane Congress 2026 Event Background

Thailand food processing industry generates a huge amount of wastewater and waste each year.Wastewater from factories such as cassava starch factories, beer factories, canned fruit factories, palm oil factories, sugar factories, or the livestock sector such as pig, cow, and chicken farms, community sectors, including various establishments that produce agricultural waste or energy crops, which these wastes can be used to produce a variety of biogas.Biogas is gas that is produced from the fermentation and decomposition of organic matter, such as from people, animals, plants, and other living things that have died. It is decomposed by a group of anaerobic microorganisms, or those without oxygen, that decompose organic matter until it is transformed into biogas.Biogas is primarily composed of methane gas and has good flammability properties. Therefore, biogas is used as a fuel source to produce energy in three main forms: producing thermal energy, producing mechanical or electrical energy, and producing combined energy (Cogeneration System) that can produce both electricity and heat.For this reason, biogas is a type of renewable energy that can be used to replace natural gas, cooking gas, and fuel oil very well, such as as fuel, for combustion to produce heat, as a substitute for fuel oil in steam boilers, for running internal combustion engines, and for running engines to generate electricity. It is therefore considered an important alternative energy in Thailand.Electricity production from biogas: Since the production of biogas from the fermentation of energy crops, Napier grass, cow dung, pig dung, wastewater from cassava flour or palm oil factories is in small quantities, electricity production using internal combustion engines is suitable for the amount of biogas produced.Electricity generation using an internal combustion gas engine system. The internal combustion engine uses natural gas and biogas as fuel. The operation of the engine is similar to the operation of a gasoline-powered car engine, which requires ignition using a spark plug. The engine then rotates the generator.The biogas production process begins with sending energy crops or animal waste into a "biogas digester" to produce biogas, which can be used for electricity generation, household fuel, and industrial purposes.Biogas is used to produce electricity. It is used as fuel to drive engines and generators to produce electricity and feed it into the transmission lines. Some of it can be used in homes or factories in the area. Another portion can be distributed through the transmission lines of the Electricity Generating Authority of Thailand (EGAT) or the Provincial Electricity Authority (PEA).

In addition, the residue from biogas fermentation can be used as a "waste" to produce renewable fertilizer to replace chemical fertilizers for agricultural use, which can also be used in energy crop fields.

Biogas is considered one of the country's most important renewable energy sources. Thailand is an agricultural and industrial country, and as such, it has a wide variety of raw materials that can be used to produce biogas, such as waste or wastewater from the food processing industry, livestock, community and business sectors, or even agricultural waste.

In the past, Thailand has supported the private sector, which has raw materials that can be used to produce biogas, to construct biogas production systems and use the resulting biogas as a substitute for oil and gas for heat and electricity production. This has been considered a success.

The Department of Alternative Energy Development and Efficiency (DEDE) has therefore determined that biogas will be used as an alternative fuel to produce a total of 600 megawatts of electricity and 1,000 tons of oil equivalent (ktoe) of cogeneration power under the Alternative Energy Development Plan 2012-2021 or AEDP 2012-2021, at a proportion of 25% over 10 years.Currently, the first revised version of the Alternative Energy Development Plan 2018-2037 (AEDP 2018) sets a target for electricity production from biogas (wastewater/waste) to increase by 183 megawatts, with existing contracts for 382 megawatts, or a total target of 565 megawatts in 2037, and biogas from energy crops to increase by 1,000 megawatts in 2037, totaling 1,565 megawatts, or 6% of renewable energy.In 2021, the community power plant project for the grassroots economy is being prepared to be launched, with a target of purchasing 75 megawatts of electricity from biogas, reflecting Thailand's potential for generating electricity from biogas.However, in 2020, the Energy Regulatory Commission (ERC) promoted the private sector to play a role in investing in renewable energy generation through incentive measures on electricity purchase prices for renewable energy generation from biogas fuel.

As of 30 September 2020, there are 430 MW of biogas power plants with commitments, 183 producers, and 108 MW of self-consumption electricity generation (IPS) with 37 producers, out of the target of the Alternative Energy Development Plan 2015�C2036 (AEDP2015) of 1,280 MW, with 742 MW remaining from the plan.

Thailand biogas sector will scale up, targets a 5,570 MW bioenergy capacity by 2036.Thailand has an illustration plan to increase biomethane production to 4,800 tons per day in the next decade, so that��salmost two hundred times. But what we expect is that the role of biogas and biomethane will be much more important than what is currently in the energy transition plans.

Thailand has biogas production potential for livestock, industrial plants, and communities, totaling 1,406 million cubic meters per year. This can be used to produce 703 million kilograms of compressed biomethane gas (CBG), which costs 12.28 baht per kilogram. This can replace 598 million kilograms of liquefied petroleum gas (LPG), valued at 13,319 million baht per year.

CBG gas is a new alternative energy source that can be produced domestically and can be applied in both the household sector as a substitute for cooking gas (LPG), the industrial sector as a fuel source in manufacturing processes, and as a fuel for commercial vehicles. Furthermore, producing CBG gas as a new alternative energy source for Thailand will help reduce the cost of energy imports from abroad.

Key Features

Overview of Thailand biogas industry policies and regulations

How to plan design and execute succesful biogas project from the plan to the full scale production

Discover new tools and policies to make sure your project is bankable

The latest technological advancements in biogas to biomethane upgrading

Challenges and opportunities faced by biogas producers

The latest solutions ensuring the safety of biomethane production and transportation

Grow your business, your network and your network of equipment and service provider

Increase your depth of knowledge in technology, and new business strategies

Asean Biomass Utilization Congress 2026 Event Background

Thailand has high potential for developing the biomass industry as it is an agricultural country with a large agricultural output. Biomass raw materials in Thailand come from three main sources: agriculture, forestry, and industry (Department of Alternative Energy Development and Efficiency, 2022). Thailand has a potential for agricultural biomass waste of approximately 61 million tons per year, with the largest biomass being rice straw, followed by sugarcane leaves and tops, palm leaves and branches. In addition, waste from agricultural processing in the industrial sector is also an important source of biomass, such as bagasse, rice husks, cassava liquor, and empty palm fruit bunches.It is estimated that the Thai food and agro-processing industry generates more than 20 million tons of this biomass per year, most of which is used for energy generation within the factory. However, there is potential for other utilizations, such as economic forest plantations such as eucalyptus, Acacia, and pine, as well as wood waste from pruning. It is another potential biomass source. Thailand's economic forest plantations cover approximately 4.8 million rai, which has the potential to produce 10-15 million tons of wood for energy per year. These biomass have the potential to produce more than 40,000 thousand tons of oil equivalent, accounting for more than 40 percent of the country's final energy consumption. It shows the differences in the proportions of cellulose, hemicellulose, and lignin in each type of biomass, which affects the suitability for use in various processing processes. Biomass with a high cellulose proportion, such as rubberwood chips and sugarcane bagasse, is suitable for the production of ethanol or biochemicals, while biomass with a high lignin content is suitable for direct thermal energy production.

Currently, Thailand primarily utilizes biomass for energy production, with 227 biomass power plants supplying electricity to the grid, with a total installed capacity of 3,892 megawatts (Department of Alternative Energy Development and Efficiency, 2022). Biomass is also being processed into biofuels such as ethanol and biodiesel. In 2022, Thailand produced a total of 1.58 billion liters of ethanol and 1.62 billion liters of biodiesel (USDA, 2023). The development of the biochemical industry from biomass in Thailand is still in its early stages, but there has been continuous investment and research and development, particularly in the bioplastics and organic acid industries. This is in line with the Thai government's BCG (Bio-Circular-Green Economy) economic model policy (National Council for Higher Education, Science, Research and Innovation Policy, 2021).

Direct combustion is the most widely used technology for heat and electricity generation from biomass, with an electricity generation efficiency of 20�C40% depending on the size and technology of the system. In Thailand, this technology is used in biomass power plants with main raw materials such as bagasse, rice husks, rubber wood waste, etc.

Gasification is a process that converts biomass into fuel gas or syngas in oxygen-limited conditions at temperatures of 800�C1,200 ��C. The main components of the produced gas are carbon monoxide (CO), hydrogen (H2), methane (CH4), and carbon dioxide (CO2), which can be used to generate electricity, heat, or synthesize liquid fuels and biochemicals. Thailand has implemented this technology on a prototype and partially commercial scale, with a total generating capacity of approximately 50 MW by 2021.

Pyrolysis is a process of decomposition of biomass in anaerobic conditions at temperatures of 300�C600 ��C. The main products produced are bio-oil, biochar, and fuel gas, with the proportions of these products depending on the processing conditions. Fast pyrolysis at 500 ��C can produce bio-oil by dry weight up to 75%. This bio-oil can be further upgraded to fuels or biochemicals.

Hydrothermal processing is a process that uses water at high temperature and pressure to process high moisture biomass such as algae and organic wastes. The type and amount of products obtained depend on the processing conditions, including biochar (180�C250 ��C), bio-oil (250�C375 ��C), and fuel gas (>375 ��C).

Thailand has developed the Alternative Energy Development Plan (AEDP) to guide the country's renewable energy development. The latest AEDP 2018-2037 targets a 30% share of renewable energy consumption in final energy consumption by 2037 (Ministry of Energy, 2019). For biomass energy, the plan targets a total generating capacity of 5,570 megawatts, focusing on the development of small-scale community biomass power plants and promoting the use of pellets in the industrial and household sectors. Key factors contributing to the success of the AEDP policy include an attractive electricity purchase price structure in the form of a Feed-in Tariff (FiT) and investment promotion measures from the Board of Investment (BOI).

The Thai government announced the Bio-Circular-Green Economy (BCG) model as a national agenda in 2021 to promote environmentally friendly economic development, with key sectors in the agriculture and food industry, energy and biomaterials. The BCG policy significantly promotes the development of the biomass industry in Thailand, particularly by supporting research and development of biomass processing technologies to produce energy and high-value bioproducts, which aligns with the concepts of the circular and green economy. Furthermore, the policy focuses on developing the grassroots economy by encouraging local communities to participate in biomass management and processing to generate income and improve their quality of life.

Thailand offers a variety of investment promotion measures in the biomass industry. The Board of Investment (BOI) has designated renewable energy and biochemical-related activities as special target industries, receiving the highest level of incentives. These include an eight-year corporate income tax exemption, an exemption from import duties on machinery, and a 50% corporate income tax reduction for five years (BOI, 2023). Furthermore, the Energy Conservation Promotion Fund (ENCON Fund), under the Ministry of Energy, provides financial support for small-scale renewable energy projects and biomass technology research and development. These financial support measures are crucial in stimulating investment in Thailand's biomass industry, particularly at a time when technology costs remain high and price competitiveness against fossil fuels remains limited.

The development of the biomass industry in Thailand also plays a significant role in generating carbon credits, which play a crucial role in achieving carbon neutrality by 2050. Currently, carbon credits from biomass energy are traded in the Thai market at an average price of 174.52 baht per ton of CO2 equivalent. In fiscal year 2024, 293,846 tons of biomass carbon credits were traded, representing the highest share in the Thai carbon credit market (The Nation, 2025). Furthermore, expanding the production capacity of biochemicals from biomass feedstocks, such as the bioplastics industry (ADB, 2023), not only helps replace fossil-based products but also generates additional carbon credits from environmentally friendly production processes. However, the rapidly increasing demand for carbon credits has resulted in a shortage of carbon credits in the market. This situation presents an opportunity for the biomass industry to expand its role in developing new technologies to increase the efficiency of carbon credit production and high-value bioproducts, which will be a key mechanism for driving the BCG economy and achieving the country's sustainable development goals in the long term.

Biomass energy helps increase the country's renewable energy share. According to the AEDP 2024, Thailand aims to reach 36% of final energy consumption by 2037. In 2020, biomass accounted for 17.4% of total renewable energy. Furthermore, promoting the use of ethanol and biodiesel can reduce crude oil imports by 10�C15% and greenhouse gas emissions in the transportation sector. Biomass energy also promotes the decentralization of production to rural communities, such as community biomass power plants and household biogas systems, which increase energy access and reduce inequality. It also reduces the reliance on imported energy, which accounts for as much as 60% of total energy consumption.

The biomass industry creates over 200,000 jobs in rural areas, particularly in agriculture and processing. Community biomass projects also reduce labor migration and boost local incomes, adding economic value to the processing of waste materials. Skill development in the clean energy sector is another key issue, with renewable energy projects helping to upgrade the skills of rural workers.

Thailand has been researching and developing various biomass technologies, which help increase resource efficiency and reduce environmental impacts. In addition, the use of biomass in energy-intensive industries helps reduce greenhouse gas emissions. Investment in infrastructure, such as biomass storage systems, processing plants, and logistics, is a key driver in the biomass industry.

The development of the biomass industry is also in line with the circular economy concept in the BCG policy, which helps increase resource efficiency and reduce waste in line with sustainable consumption and production (SCP) guidelines. Examples of sustainable bio-products include bioplastics, which are produced at 95,000 tons/year and exported to the European Union and Japan.

The use of biomass instead of fossil fuels can reduce greenhouse gas emissions and reduce open burning, a major source of PM2.5. A life cycle assessment found that the use of biomass ethanol fuel can reduce CO2 emissions by 30�C60% compared to conventional fuels. Furthermore, Thailand's carbon credit program (T-VER) has a 40% share of biomass and biogas, and carbon trading is expected to grow in line with the target of carbon neutrality by 2050.

Thailand has high potential due to its diverse agricultural feedstock base. Modern processing technologies, such as fluidized bed gasification, fast pyrolysis, and hydrothermal liquefaction, are more efficient and can process a wider range of biomass. Furthermore, the application of the biorefinery concept, which produces energy and multiple high-value products from biomass in a single facility, increases economic value and investment efficiency. International cooperation and technology transfer are another opportunity.

Since biomass is readily available locally in Thailand, biomass energy production is a suitable avenue to increase local income. In addition to trading agricultural products, it also generates income from the sale of scrap materials that would otherwise be discarded. It also helps reduce production costs, develops local downstream industries, and strengthens and encourages community participation. Furthermore, it also reduces energy imports from abroad.

In addition to biomass' contribution to local economic development, exporting biomass products internationally also presents another opportunity to generate domestic revenue. For example, the Japanese market relies heavily on imported biomass due to limited domestic biomass resources. The Japanese government's renewable energy policy aims to increase renewable energy use from 16.1% in 2017 to 22-24% by 2030, resulting in increased demand for biomass. Japan primarily imports wood chips and wood pellets for use in biomass power plants. In 2022, more than 4 million tons were imported, this import volume is expected to continue to grow, presenting an investment opportunity for Thai entrepreneurs in the biomass business.

Advanced biofuels are second-generation biofuels produced from environmentally friendly energy crops and from raw materials that are not directly in the food production chain, such as agricultural and food waste.

In Thailand, the Bangchak Group has established a SAF production unit, collecting used vegetable oil from households and businesses, going through a quality improvement process (Pretreating) and entering the SAF production process, with a production target of 1 million liters per day. Thailand also has a lot of raw materials for SAF production, such as agricultural waste.

Key Features

How to establish an economically sustainable integrated industrial chain of "purchasing, storage and utilization" of biomass raw materials, fully realizing the commercialization of biomass energy and increasing its added value

How to attract social investment and increase rural income

How to improve the overall efficiency and economy of the system

Construction of biomass power generation standard system

How to improve technology and explore new models to control pelleting fuel costs

In terms of environmental protection, project scale and initial investment, operational benefits

R&D and promotion of diverse technologies for biomass energy utilization

Development and utilization of active biomass energy

Classify and rationally utilize dry and wet biomass resources, focus on research and development,and prioritize breakthroughs in some key technologies

How to realize the clever collaborative utilization of biomass energy and wind and solar energy

Debate the future of the biomass utilization market with industry leaders

Benefit from technical expertise insight from some of the industry��s leading technology providers

Network and do business with the leading biomass projects owners in the Asean countries

Discover new commercial opportunities in 2027 and beyond

Position your company at the forefront of the emerging biomass industry in the Asean region

Asean Solid Waste Management Congress 2026

Event Background

Thailand ERC amended several laws and conditions to create more potential for waste-to-energy business.The new PDP allows the regulator to adopt business models and development conditions to license private investors.The ERC consider the business model and capacity in providing two types of licences: small power producer at a capacity between 10-99MW and very small power producer for less than 10MW.Power purchase agreements is for a period of 20-25 years and the state grid has plans to buy power from this renewable resource.Licence holders have to comply with a single rule: quick development during a stipulated time frame to avoid any delays and postponement.The MEA oversees waste-to-energy projects in Bangkok, Nonthaburi and Samut Prakan, while the PEA supervises the remaining 73 provinces.

The first phase of waste-to-energy, with combined capacity of 344MW, ran from 2016 to 2020. Community waste was used to produce 313.2MW of electricity while industrial waste was used to produce 30.8MW.

Part of the waste fuel was used to produce heat which was supplied to factories, especially for food processing and cloth dyeing. The heat volume stood at 135 kilotonnes of oil equivalent.

The second-phase development consists of 34 projects to be operated by small power producers, each with an electricity generation capacity of 10-50 megawatts, and very small power producers, each with less than 10MW in capacity.Total capital expenditure is estimated at 50 billion baht for the development of the projects, with a combined capacity of 282.98MW.Authorities' target is for 600MW of electricity to be produced under the second phase of the waste-to-energy scheme, with 200MW from industrial waste and 400MW from community waste.The ERC help local administrative bodies deal with waste in their areas through the waste-to-energy scheme.The Interior Ministry oversees local administrative bodies nationwide, supports the scheme under its cooperation with the Energy Ministry. The scheme gained approval.Authorities are encouraging investors to join the scheme by offering them feed-in tariffs ranging from 1.81-5.08 baht per kilowatt-hour over 20 years.The ERC expects waste-to-energy projects to start commercial operations between 2025 and 2026.

According to the Ministry of Interior's Department of Local Administration (DLA), 79 waste-to-energy projects are planned nationwide, which will have a combined power generation capacity up to 619 megawatts and be capable of incinerating up to 33,006 tonnes of waste per day.Of them, 22 projects are still at the consideration process, and 11 projects have been operating since 2019 as part of a waste-to-energy investment promotion scheme under the Quick Win Project.Meanwhile, nine new waste-to-energy projects and 12 new refuse-derived fuel (RDF) plants under the DLA's plan will be ready for operation within the next three years, after the national energy policy board approved an agreement to start buying power from the plants in 2025.

The Interior Ministry and the Ministry of Natural Resources and Environment has designated areas for waste-to-energy projects in 24 provinces: Ayutthaya, Buri Ram, Chiang Mai, Chon Buri, Khon Kaen, Krabi, Loei, Lop Buri, Maha Sarakham, Nakhon Phanom, Nakhon Ratchasima, Nakhon Sawan, Nonthaburi, Pathum Thani, Phatthalung, Phitsanulok, Phuket, Rayong, Samut Prakan, Songkhla, Surin, Ubon Ratchathani, Udon Thani and Yala.

Authorities are not just focused on incineration at waste-to-energy plants, but considering how the national action plan can manage municipal solid waste and plastic waste.

Thailand's waste-to-energy market continuously expanding,The main driving force is government policy to solve the waste problem and promote renewable energy. Including the growth of industries that require the use of waste fuel (RDF) to produce heat energy. and the increasing demand for electricity from waste-to-energy plants which is supported by government investment promotion measures.

In 2025, the RDF waste fuel market value is expected to increase by approximately 6.3% due to government support in waste management and the transition to renewable energy, which will support the expansion of the RDF waste fuel business market.RDF demand in the electricity sector is expected to grow by around 9.9% in 2025, driven by government support leading to more waste-to-energy plants.Meanwhile, the demand for RDF for thermal energy production in the manufacturing sector is expected to increase by 1.1% due to the transition to renewable energy and the reduction of dependence on coal from the CBAM measure.

In 2025, the amount of solid waste is expected to grow by 0.3% to 27.8 million tons, slowing down from 2.9% growth in 2024. This will result in more than 2.5 million tons of solid waste that can be converted into RDF fuel.The amount of solid waste in Thailand is expected to continue to increase, forcing the government to push for policies to deal with the waste problem. One of the main policies is to turn waste into energy. Although the Thai population has decreased since 2019, consumption behavior such as ordering food online and the recovery of tourists after COVID-19 continue to increase waste volume. This growth indicates the need to promote the use of waste to produce energy, which not only reduces the amount of waste remaining but also reuses waste as a resource for energy production.Solid waste volume and the government��s promotion of proper waste separation This has resulted in the growth of the amount of waste that can be converted into RDF for energy production. In 2023, the amount of waste that was properly disposed of was 37.7% of the total waste, an increase of approximately 7% compared to 2015. This improvement has resulted in the same increase in the amount of waste that can be converted into RDF. Of this amount of waste that can be converted, the actual waste that went into the RDF production process has increased from 18.5% in 2015 to 42.9% in 2023 and is expected to increase to 44.4% this year and 47.0% in 2025. This growth is the result of collaboration between waste collection agencies and RDF production plant operators, as well as the promotion of proper waste separation for energy production.In 2025, it is expected that 61% of all RDF will be used for electricity generation. The demand for RDF for electricity generation is expected to grow by more than 9.9%, in line with an 8.2% increase in waste-to-energy generation capacity.The demand for RDF for electricity generation is increasing due to government promotion, which has set a higher purchase rate for electricity from waste than other renewable energy sources. In 2022, the Energy Regulatory Commission (ERC) opened a purchase agreement for 282.98 megawatts of electricity from community waste, with power plants slated to begin supplying electricity to the grid between 2025 and 2026. The purchase rate for very small power producers with a production capacity of no more than 10 megawatts is 5.08 baht/unit, with a FiT Premium of 0.70 baht/unit for the first 8 years. For small power producers with a production capacity of 10-50 megawatts, the purchase rate is 3.66 baht/unit, higher than solar and wind power, which have purchase rates of 2.22 baht/unit and 3.10 baht/unit, respectively. These higher purchase rates have attracted entrepreneurs to invest in community waste-to-energy power plants. There are a total of 31.5 megawatts of power plants waiting to supply electricity to the system in 2025, which means that the demand for RDF is expected to increase by approximately 65,000 tons next year.Currently, the Energy Regulatory Commission (ERC) has no plans to purchase additional electricity from municipal waste (WW) as mentioned above. However, it is preparing to purchase an additional 30 megawatts of electricity from industrial waste, most of which will use RDF from industrial waste produced in factories. This will not affect the demand for RDF from municipal waste. However, in the long term, the demand for RDF from municipal waste is expected to increase, in line with the draft Alternative Energy Development Plan 2024-2037 (Draft AEDP 2024), which has adjusted the target for electricity generation from municipal waste to 1,142 megawatts. If the government aims to achieve this goal, it will need to increase electricity generation from municipal waste by an additional 752.7 megawatts, which will increase the demand for RDF to 1.3 million tons in the future.In 2025, 39% of RDF consumption is expected to be consumed in the manufacturing sector, a volume increase of approximately 1.1%, driven by a 1.8% increase in heat energy demand from waste,the transition to renewable energy, and the reduction of reliance on coal in industrial sectors such as cement production. This is driving the demand for RDF to increase significantly. Between 2015 and 2024, the use of industrial waste-to-energy thermal energy grew by an average of 8.5% per year, while coal use decreased by an average of 5.3% per year. Although the cost of using RDF is higher than coal, the European Union (EU) CBAM measure that charges fees for high-carbon-emitting products has forced carbon-intensive manufacturing industries, such as cement, to adapt to reduce carbon emissions. It is expected that in 2025, RDF use will increase by approximately 5,000 tons, replacing approximately 2,100 tons of coal. Reducing coal use by 1 ton requires approximately 2.35 tons of RDF.

In summary, the value of the RDF waste fuel market in 2025 is expected to grow by approximately 6.3% from 2024, reaching 1.8 billion baht.

In 2026, the RDF waste fuel market value is expected to increase by approximately 15.1% due to government support in waste management and the transition to renewable energy. RDF demand in the electricity sector is expected to grow by approximately 16.8% in 2026, driven by the arrival of waste-to-energy power plants.Meanwhile, the demand for RDF for thermal energy production in the manufacturing sector is expected to increase by 10.8%. The increasing trend of solid waste, driven by consumer behavior such as online food ordering and the recovery of tourism, has led the government to push for policies to address the problem of overflowing urban waste. One key policy is the transformation of waste into energy, such as the conversion of solid waste into Refuse Derived Fuel (RDF). This method not only reduces the amount of waste remaining but also demand for RDF for electricity generation has increased due to government promotion, which has set a higher purchase rate for electricity from waste than other renewable energy sources. The purchase rate for electricity from 282.98 megawatts of community waste during 2025-2026 is 3.66-5.78 baht/unit, while solar and wind power have purchase rates of 2.22 baht/unit and 3.10 baht/unit, respectively. This higher purchase rate has attracted more entrepreneurs to invest in community waste power plants, leading to an expected demand for RDF reaching 6 million tons next year.

By 2037, RDF demand for the electricity sector will reach 15 million tons, according to the Alternative Energy Development Plan 2024-2037 (draft AEDP 2024), which targets 1,142 megawatts of electricity production capacity from community waste. However, the Energy Regulatory Commission (ERC) currently has no plans to purchase electricity from community waste beyond the aforementioned sources. However, it is preparing to purchase an additional 30 megawatts of electricity from industrial waste, most of which will be generated from industrial waste produced in factories, thus eliminating the need for RDF from community waste.

It is expected that by 2026, coal use for thermal energy generation will decrease by 6.6%, with RDF use increasing by approximately 300,000 tons. Although the cost of using RDF for thermal energy generation is higher than coal, the European Union (EU) CBAM measures that charge fees for high-carbon products mean that carbon-intensive manufacturing industries, such as cement, need to adapt to reduce carbon emissions. However, the growth in the amount of solid waste in the country may not be enough to meet future RDF demand.Of the total solid waste, only 35%, or approximately 9.5 million tons, can be converted into RDF. The remaining waste is either unsuitable for RDF conversion or is recycled. By 2024, over 82% of the solid waste that can be converted into RDF has already been produced. Therefore, Thailand's solid waste growth may not be sufficient to support the growing demand for RDF in both the electricity and thermal power sectors, which are expected to continue growing in the future. Therefore, proper waste separation and collection are key issues that must be promoted in the future to increase the amount of solid waste that can be converted into RDF.

Key Features

How to shorten the project preliminary examination planning,environmental assessment,feasibility study, approval,land approval,report construction land acquisition,demolition and resettlement coordination time

How to coordinate finance,development and reform,land,planning,environmental protection,legal departments efficiently

How government and investors resolve the conditions for cooperation in fairness and impartiality, major legal risks, and operational maintenance effectively

How to promote the project quickly during a stipulated time frame to avoid any delays and postponement

How to design a YIMBY waste incineration project, process technology, project building standard, waste disposal service fee

How to build safe,high standards, high quality waste incineration power generation project

How to leverage cloud computing, digitization, big data, artificial intelligence, and IoT technologies to improve combustion power generation efficiency and reduce flue gas emissions

Waste incineration power generation projects operational excellent management

Waste incineration power plant equipment fault prediction and maintenance,clean compliance incineration, improve enterprise economic benefits

How to assist waste incineration power plants to treat exhaust gas(hcl sox nox pm dioxin mercury), waste leachate,slag,bottom ash,fly ash

How to assist decision makers in urban msw management departments to sort and collect transport work well

Debate the future of the emerging waste management market with industry leaders

Benefit from technical expertise insight from some of the industry��s leading technology providers

Network and do business with the leading wte projects owners in Thailand

Discover new commercial opportunities in 2027 and beyond

Position your company at the forefront of the emerging WtE industry in Thailand

|